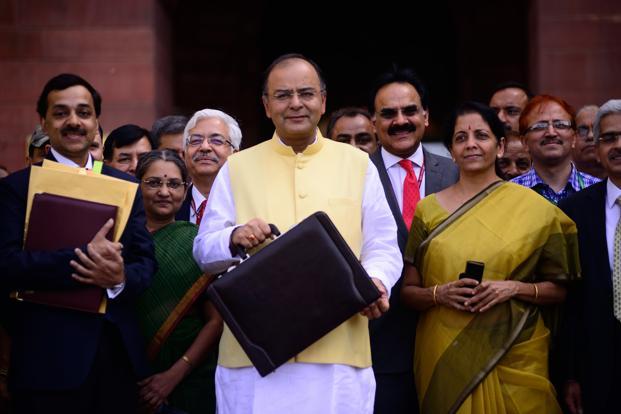

ImageCourtesy: livemint.com

Budget 2016-17 was declared on the rare 29th of the last month, amid a pretty dismal economic scenario. Monthly credit growth has been on a secular decline for a while, accompanied by dwindling exports and private investment figures. The Index of Industrial Production plunged to a 4-year low in January. But the crisis on the production front is a function of three factors, which in themselves are a major cause of concern for the competitiveness of the economy. The first is an extremely unfavorable rural demand resulting from three consecutive failed rains and the losses to agriculture accompanied by multipliers, therein involved. The second, though not to the extent of the first, is flagging exports, which result from the unfavorable demand conditions in the West. The third is the persistent crisis of need for structural reform with regard to banking and investment, which the government was too vocal in promising, but not as excited in bringing about.

All these factors put the Budget in a position of enhanced significance for two reasons. A) Tepid private investment means that the volume and nature of public spending would be of great consequence, and B) Raising the level of rural demand and soothing the simmering agrarian distress squarely become the government’s responsibility. It is in this light that one sees the Budget to have arrived as a course correction, bringing the much needed attention to the crisis on the rural front. Much against dismissing this budget as ‘Povertarian’ as journalist Shekhar Gupta did, one notes the much required shift of focus to the rural sector for sustained growth.

There were many things that the government did right in this budget. First, it stuck to fiscal consolidation. Given the temptation to spend for growth when the free market engines are down, a deviation couldn’t have been absolutely unjustifiable, but it could have been pretty risky – there already are upward pressures to inflation with the implementation of OROP and the recommendations of the 7th Pay Commission that would follow this fiscal. Similarly, RBI projections of inflation assume normal rains, apart from negating the inflationary impact of the above two phenomena. This coupled with a deficit could have restricted any further monetary easing, further suffocating private investment and credit off take. Second, the government funneled its spending well. For all the huff and puff, the centrality of MGNREGA, especially in times of failed rains is too pronounced to miss. The government recognized this sometime back, and the much needed funds were released. Working days were also increased, though a little late through the crisis. From an all-time low of 166 crore person-days of employment in 2014-15, the government has now raised its aim to generating 215 crore person-days. It also raised spending on road construction, an activity that runs into the interiors and can provide much needed incomes.

The budget also saw an uptick on social sector spending – yet aggregate education and healthcare expenditure remains regrettably low for the economy, and this is a persistent roadblock to inclusive growth. Nevertheless, given the pennies that were released to these sectors the previous fiscal, the current budget was much more generous. We thus derive some solace from the mere relative perspective.

Looking at sustained growth in the long run, one gauges the necessity to raise rural incomes and wages. The current slack in the exports is a function of the crisis in the West, and such crisis of demand are speculated to recur for multiple reasons – the ageing Western population, the ballooning debt crisis and the devaluations of the remninbi that are likely to keep placing Indian exports at a disadvantage as the Chinese economy settles at its new normal. India’s growth model since the reforms that began in the mid-1980s has been primarily lead by domestic demand in the service sector. That domestic demand and domestic investment must be diversified and be made more inclusive will be the safest growth strategy, while of course, not building an environment that is too protectionist and foreign investment averse. So, how do we raise rural incomes in the medium to long run?

Arthur Lewis, Nobel Laureate, introduced the Lewisian Turning Point (LTP) to describe the rise in rural wages. The subsistence sector in a developing economy holds a large quanity of excess labour, which is seen in tricky cases of mass underemployment and disguised unemployment. India, historically being a prominently agrarian society, the agriculture sector is the subsistence sector. When growth starts producing a shift of labour from the subsistence sector to the modern sector, a structural shift is initiated. Rural wages begin to rise after a passage of time once this process has begun, when surplus labour in the subsistence sector has been transferred to the modern sector and the marginal productivity of subsistence sector labour starts exceeding the subsistence sector wage.

In India, the modern sector has usually taken the form of the construction sector, trade, hotels, transport, etc. While manufacturing has played a role, that role has been less prominent.

A Amarender Reddy notes in his paper ‘Growth, Structural Change and Wage Rates in Rural India’ (The Economc and Political Weekly, vol.2, January 2015), the incidence of rise in rural wages going by the LTP in India. He classifies among high wage rate states and low wage rate states and shows a rise in wage rates in states such as Kerala, Haryana, Punjab, Tamil Nadu, Himachal Pradesh, and a not-so-pronounced rise in states of Gujarat, Maharashtra, Andhra Pradesh (including Telangana) and West Bengal. One observes that low wage rate states have typically resorted to urban-lead growth model, which seems to be less inclusive, while high wage rate states typically have resulted from more inclusive growth, increased agricultural productivity and literacy and health indices. This speculation falls in line with the findings of Datt and Ravillion (2002), who conclude that while rural as well as urban poor gain from rural growth, only the urban poor gain from urban growth, making it less inclusive.

As far as bringing about rural growth is concerned, then, one refers to ‘Growth, Structural Change and Poverty Reduction’ where Sneha Lamba, Rana Hasan and Abhijit Sen Gupta describe two methods of rural poverty alleviation – increasing within sector growth in agriculture and shifting labour from agriculture to more productive sectors. They conclude the latter to be a surer growth strategy.

The centrality of rural growth working partially, if not wholly, through the Lewisian spiral is established. This would require a manufacturing lead growth model, which is built on the back of robust infrastructure – growth, better education and stronger occupational mobility of labour. In other terms, the sectoral composition of India’s growth shall have to be more rural than urban and more manufacturing-oriented than service-oriented.

This shows that any long run growth strategy must see the budget focusing on shifting labour from the subsistence sector to the modern sector, and creating favorable circumstances for the growth of such a sector. So, this is what PM Modi must aim at when he seeks to fulfill his ambitious and arguably exaggerated aim of doubling farm incomes in the next five years. To attain such a stage, the budget takes few significant steps, while missing others.

In the short to medium run, much will depend upon the government’s ability to pass through crucial legislation, control inflation, rejuvenate investor confidence and restructure the mammoth NPA crisis in the public sector banks, so that recovery in the private sector is not hindered by inability to create credit and transmit monetary expansion. On the taxation front, a more progressive than regressive tax regime could have helped, but overall, the budget acts as an apt course correction for meeting long term and short term growth requirements.

Disclaimer: The opinions expressed within this article are the personal opinions of the author. Spectralhues is not responsible for the accuracy, completeness, suitability, or validity of any information on this article. The information, facts or opinions expressed in the article do not reflect the views of Spectralhues and Spectralhues does not take any responsibility or liability for the same.

Tags: Arun Jaitley BJP Budget 2015-17 Finance Minister Lok Sabha NDA Rajya Sabha